Understanding Health Coverage

You want to do what’s best for you and your family. Understanding health coverage will help you decode the maze of health benefit options available today. From HMOs and PPOs to Medicare and drug coverage, learn the facts so you may make more informed choices about your health coverage and your future.Getting Health Coverage

You can get health coverage through an employer or purchase it yourself. Get the basics on getting health coverage.Types of Health Coverage

Knowing what is covered ahead of time is a key to finding the right plan for you. From medical care to prescriptions to dental or vision, learn about the types of health coverage available to you.Types of Products

You’ve heard terms like PPO, HMO and deductibles, but what do they mean? Get the information you need to make your best choice with our guide to different types of products.Economics of Health Care

Find out more about health care costs through our Economics of Health Care series. Its educational materials will help you identify health care costs, understand cost drivers and learn what we can all do to lower these costs.Glossary of Terms

Some insurance and medical jargon may make understanding health insurance difficult. We want to make it easier for you by providing clear definitions of common health insurance terms.Getting Health Coverage

Many people get health coverage through their employer. This is called group coverage. Employers may offer several plans to choose from, and employees get a chance to change their plan once a year during open enrollment.Some people purchase their own coverage because it is not available through their employer. This is called individual health insurance coverage. Individual health insurance coverage is a good option for people who are:

- In between jobs

- Self-employed

- Early retirees

- Recent college graduates

- Part-time workers

Understanding Medicare

Medicare is a federal program to help eligible Americans pay for the high cost of health care. Medicare health plans provide different ways to get your health care coverage.Medicare Basics

Before your 65th birthday is the time to start thinking about Medicare.That means understanding what Medicare is, how and when to enroll, and what it does and does not cover. It’s also time to think about the options available that can help protect you from some of the expenses not covered by Medicare. The Medicare health plan that you choose affects many things like cost, benefits, doctor choice, convenience, and quality. Need some help understanding your choices for Medicare coverage?Discover the types of Medicare programs offered, who can be in Medicare programs and more.

Blue Cross and Blue Shield of Texas is not connected with or endorsed by the US Government, the Federal Medicare Program or any other governmental agency.

Types of Health Coverage

Health insurance plans come in all shapes and sizes. That's why it's important to assess your needs before you choose an insurance plan. First, determine what kind of coverage you need, for example, a major medical insurance plan or a temporary insurance plan. A major medical insurance plan usually renews on a yearly basis and does not expire until you decide to terminate the policy or discontinue paying premiums. On a temporary insurance plan, you can decide if you want coverage from one to eleven months.Major medical insurance plans usually offer an optional dental plan. The dental plan is only offered along with the health insurance plan - it cannot be purchased alone. Additional services that could be included with a health insurance plan are preventive care, prescription drug coverage and vision coverage. It is important to do research so you can find the insurance plan that provides the best coverage and services for you.

Types of Products

The three most common types of health plans are Health Maintenance Organizations (HMOs), Preferred Provider Organization insurance plans (PPOs) and Consumer Directed Health Plans (CDHPs).HMOs

HMOs, available through participating employers, are a type of health plan that gives you access to certain doctors and hospitals, often called network or contracting doctors and hospitals (sometimes called "providers").HMO basics:

- When you sign up, you select a primary care physician (PCP) from a network of doctors.

- Your PCP is your first point of contact for most of your basic health care needs.

- Women can also select an OB/GYN for obstetrical and gynecological care.

- If you need special tests or need to see a specialist, your PCP will give you a referral to see another doctor.

The bottom line:

- HMO plans generally have lower up-front costs, or premiums, than other types of plans.

- HMOs usually feature copayments as well. Copayments are set amounts (usually a dollar amount or a percentage) that you pay for care. An example of a copayment is $20 for each office visit.

- HMO plans generally provide coverage only when you use doctors, hospitals and specialists that are in the network.

- If you seek care outside the network, other than in an emergency or with authorization from your HMO, your care typically will not be covered at all.

PPOs

Like HMOs, PPOs often feature a network of doctors, specialists and hospitals; however, there are some key differences between the two types of plans.PPO basics:

- With a PPO insurance plan, you don't have to choose a primary care physician.

- You have the option of receiving care from doctors, hospitals and specialists in the network or outside the network, and you don't always need a referral to see a specialist.

- PPO insurance plan premiums are generally higher than HMO plans, which means you'll have to pay more up front.

- When you receive care from a doctor or hospital that is in the network, your costs tend to be lower.

- When you receive care from a doctor or hospital outside the network your costs are likely to be higher, and you may be responsible for the difference between the amount your insurance plan pays and the provider's billed charges.

- PPO insurance plans usually have a deductible. So, for example, if your PPO insurance plan has a $500 deductible, your coverage doesn't begin until you've paid out-of-pocket for the first $500 of your own medical expenses. Preventive care services are not subject to the deductible

CDHPs and the HSA Option

Consumer Driven Health Plans (CDHPs) often involve pairing a high deductible PPO insurance plan with a tax-advantaged account, such as a Health Savings Account (HSA)1. For an individual to establish an HSA and contribute money to the account each year, he or she must be considered an HSA-eligible individual. Eligibility includes enrollment in an HSA-qualified high deductible health insurance plan.Guidance on choosing a health insurance plan: U.S. Agency for Healthcare Research and Quality (AHRQ) .

Key features:

- If the insurance plan uses a PPO network, you don't have to choose a primary care physician.

- You have the option of receiving care from doctors, hospitals and specialists in the network or outside the network, and you don't always need a referral to see a specialist.

- When a CDHP includes a high deductible health insurance plan, premiums are often lower than other types of health plans because you are responsible for a greater share of your health care costs.

- If the health insurance plan is an HSA-qualified high deductible health insurance plan, and you are an HSA-eligible individual, you may establish an HSA and make contributions to the account each year.

- An HSA is a savings account that you can use to cover a wide range of qualified medical expenses. HSAs have special tax advantages and are regulated by the Treasury Department.1

Resources

For more information about individual health insurance plans, visit the U.S. Agency for Healthcare Research and Quality (AHRQ) . This website provides guidance on choosing a health insurance plan.

1 Health Savings Accounts (HSA) have tax and legal ramifications. Blue Cross and Blue Shield of Texas does not provide legal or tax advice, and nothing herein should be construed as legal or tax advice. These materials, and any tax-related statements in them, are not intended or written to be used, and cannot be used or relied on, for the purpose of avoiding tax penalties. Tax-related statements, if any, may have been written in connection with the promotion or marketing of the transaction(s) or matter(s) addressed by these materials. You should seek advice based on your particular circumstances from an independent tax advisor regarding the tax consequences of specific health insurance plans or products.

Economics of Health Care

At Blue Cross and Blue Shield of Texas, we strive to provide affordable health care to all Texas residents. As a consumer, it’s important for you to know what your insurance pays for and what medical services and procedures actually cost.

With this in mind, we’ve created a new series: Economics of Health Care.

With this in mind, we’ve created a new series: Economics of Health Care.

Growth in medical care costs is projected to outpace inflation and increases in employee earnings. But what costs are rising the fastest, and why? Find out what's driving the increasing cost of health care.

Understanding heath care costs

The rising costs of health care are creating an unsustainable burden on consumers, employers and the government. But what things cost the most? Find out how your health insurance premium dollars are being spent.

Understanding heath care costs

The rising costs of health care are creating an unsustainable burden on consumers, employers and the government. But what things cost the most? Find out how your health insurance premium dollars are being spent. Economics of Health Care:

Identifying Health Care Costs

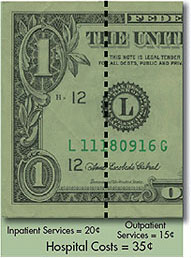

Federal government data confirms that rising health care costs are driven by increased spending on hospital care, physician services, prescription drugs and other medical services. As the dollar image below illustrates, 87 percent of every health insurance premium dollar is used to pay for such direct medical care. These medical treatment costs are rising at two to three times faster than the rate of inflation. Health care affordability and sustainability depends on creating efficiencies within the 87 percent of health care dollars directed toward health care providers.

Where does the typical health insurance dollar go1? (Roll your cursor over the dollar bill for more information.)

Insurer Margin (3%) – BCBSTX, as a non-investor-owned company, typically has a margin of less than 3 percent.

No simple task

Controlling health care costs is no simple task and will require the combined effort of the government, insurers, providers and the general public. As economic difficulties may pressure healthy individuals to go without insurance, the market includes a disproportionate number of unhealthy people who incur higher health costs. In addition, unemployment drives up the number of uninsured and increases the use of expensive visits to the emergency room.As the only statewide, non-investor-owned health insurer in Texas and the largest provider of health benefits in the state, BCBSTX makes every effort to keep its coverage affordable and accessible to all Texans. We’re committed to working with hospitals, physicians and employers to provide access to quality medical care at competitive rates.

For more detailed information, download Economics of Health Care: Identifying health care costs.

Sources

- America’s Health Insurance Plans. PricewaterhouseCoopers’ Factors Fueling Rising Healthcare Costs 2008.

Economics of Health Care:

Understanding Health Care Cost Drivers

As health care costs continue to rise, Texans are faced with increased health care premiums and out-of-pocket expenses.

What are some common drivers of health care costs?

Prescription drug spending is one of the fastest growing costs, followed closely by hospital care and physician services. Three main factors influence prescription drug costs—consumption, price fluctuations and drug types.

Americans continue to use more prescription drugs to manage their health. As billions of dollars are spent on promoting brand name drugs, both the cost and demand for these drugs continue to rise. Generic drugs (on average) are 20 percent less expensive than brand name drugs.2

Americans continue to use more prescription drugs to manage their health. As billions of dollars are spent on promoting brand name drugs, both the cost and demand for these drugs continue to rise. Generic drugs (on average) are 20 percent less expensive than brand name drugs.2

Our country is spending more on health care because we are consuming more health care services. This includes the overuse and misuse of health care, which is a major contributor to rising health care costs. For example, some people may visit the emergency room when an urgent care clinic or doctor’s office visit could sufficiently meet their needs at a much lower cost.

Another significant cost driver is a result of doctors practicing defensive medicine. Over-testing patients is a precaution that many doctors take to protect themselves from malpractice lawsuits. Nearly three-quarters of doctors practice defensive medicine at an annual estimated cost of $650 billion.3

Medical advances are another significant cost driver. While new technology can be life-saving, there is a cost involved in making such treatments available. In comparison to Canada, the United States has nearly three times as many CT scanners and four times as many MRI units per person.4 Both machines cost hundreds of thousands of dollars each.

Approximately 70 percent of all health care costs are directly related to personal behavior.5 In addition, nearly three-quarters of all costs can be traced to cardiovascular disease, cancer, diabetes and obesity. Each of these costly conditions are preventable much of the time.5

Unhealthy behaviors can result in costly chronic conditions. For example, while smoking is harmful to the user, children also can become asthmatic from being around an adult’s secondhand smoke. Research shows that people with chronic conditions generally use more health care services, which include doctor visits, hospital care and prescription drugs. Insurance works by spreading costs across the sick and healthy—so an individual’s chronic condition affects everyone’s health insurance premiums.

Each year, thousands of Texans rush to emergency rooms to receive treatment for preventable injuries. For children and adolescents alone, medical costs for preventable injuries in the U.S. are $17 billion annually.6 Simple actions—such as buckling seatbelts and consistently using bicycle helmets—can help prevent injuries and reduce costs for everyone.

It’s probably no surprise that health care fraud is a key driver of rising health care costs. Approximately 3 percent of all health care spending—or $68 billion annually—is lost to health care fraud.7 This type of fraud comes in many forms and is committed by people who provide health care services and by those who receive services. Many consumers forget that ultimately we all pay for the activities of those who abuse the system.

The health care industry also is experiencing displaced costs. Private insurers’ payments to health care providers have traditionally increased since 1999, while payments by Medicare and Medicaid have decreased over this same time.8 This process is shifting the costs from Medicare and Medicaid to private insurers, requiring private insurers to pay increasingly more and resulting in increased private insurance costs.8

Approximately 46.3 million Americans do not have health insurance9, and this growing number contributes to the increasing cost of health care for everyone. It is not unusual for people without health insurance coverage to wait to seek medical care. This can complicate a simple health problem, making it more costly to treat. In addition, people without health insurance coverage often seek treatment for nonemergency ailments in the emergency room—an expensive alternative to visiting the doctor’s office.

Another challenge to affordable health care coverage is maintaining a balance between relatively healthy people and those who experience more health issues. The sustainability of health insurance coverage is based on having a variety of people in a collective pool —both healthy and unhealthy—to share the risk of the group.

Another challenge to affordable health care coverage is maintaining a balance between relatively healthy people and those who experience more health issues. The sustainability of health insurance coverage is based on having a variety of people in a collective pool —both healthy and unhealthy—to share the risk of the group.

The Future of Health Care

After looking at the many factors that influence health care costs, it becomes clear that controlling health care costs will take a lot of effort from all stakeholders—health insurers, health care providers, the government and consumers. In future issues of Economics of Health Care, we will look at ways we can all be a part of the solution.For more detailed information, download Economics of Health Care: Understanding health care cost drivers.

Sources

- Gallup, Inc. About One in Six U.S. Adults Are Without Health Insurance. July 22, 2009.

- Kaiser Family Foundation. Prescription Drug Trends. May 2010.

- MedPage Today, LLC. Unnecessary Tests Drive Up Cost of Healthcare. February 22, 2010.

- Organisation for Economic Co-Operation and Development. OECD Health Data 2009, November 2009.

- The Wall Street Journal. How Safeway Is Cutting Health-Care Costs? June 12, 2009.

- Centers for Disease Control and Prevention. Childhood Injury Report: Patterns of Unintentional Injuries Among 0-19 Year Olds in the United States, 2000-2006. 2008.

- National Health Care Anti-Fraud Association. The Problem of Health Care Fraud.

- Blue Cross and Blue Shield Association. Health Care Trends in America. 2010 Edition.

- U.S. Census Bureau Health Insurance. “Current Population Survey, Annual Social and Economic Supplement, 2009” (Sept. 2009).

Print

Glossary of Terms

A

allowable amount

The maximum amount determined by the healthplan to be eligible for consideration of payment for a particular service, supply or procedure.allowable charge

The maximum amount a healthplan will reimburse a doctor or hospital for a given service.annual deductible

The amount of eligible expenses you are required to pay annually before reimbursement by your healthplan begins.annual out-of-pocket

The maximum amount, per year, you are required to pay out of your own pocket for covered health care services.B

C

claim form

A form generally filled out by a provider and submitted to your healthplan for consideration of payment of benefits under that healthplan.claim

An itemized bill for services that have been provided to a subscriber, a subscriber's spouse or dependents.COBRA

A federal act that requires group healthplans to allow employees and certain dependents to continue their group coverage for a stated period of time following a qualifying event which causes the loss of group health coverage. Qualifying events include reduced work hours, death or divorce of a covered employee and termination of employment.coinsurance

A percentage of an eligible expense that you are required to pay for a service covered by your healthplan.

Coordination of Benefits (COB)

An arrangement where, if you or your dependents are covered under more than one group healthplan, the plans work together to coordinate reimbursement for the medical services you received.copayment

A fixed dollar amount you are required to pay for a covered service at the time you receive care.covered person

The person in whose name a health care policy is issued and, in the case of family coverage, the member's/subscriber's dependents.covered service

A service that is covered according to the terms in your health care policy.D

deductible

A fixed amount of the eligible expenses you are required to pay before reimbursement by your healthplan begins.dependent

A person, other than the member/subscriber (generally a spouse or child), who receives health care coverage under the member's/subscriber's policy.domestic partner

A person with whom the member/subscriber has entered into a long-term, committed relationship. The relationship must meet the health care plan's specific criteria for a domestic partner.drug formulary

A list of commonly prescribed drugs (also known as a prescription drug list). Not all drugs listed in a plan's prescription drug list are automatically covered under that plan.E

effective date

The date on which your health care coverage begins.emergency medical care

Services provided for the initial outpatient treatment of an acute medical condition, usually in a hospital setting. Most healthplans have specific guidelines to define emergency medical care.Explanation of Benefits (EOB)

The form sent to you after a claim has been processed by your healthplan. The EOB explains the actions taken on the claim such as the amount paid, the benefit available, reasons for denying payment and the claims appeal process.exclusions

Specific medical conditions or circumstances that are not covered under a health plan.F

family coverage

Health care coverage for a member/subscriber and his/her eligible dependents.G

generic substitute

A prescription drug that is the generic equivalent of a drug listed on your health plan's formulary.group

A group of people covered under the same health care policy and identified by their relation to the same employer.H

Health Maintenance Organization (HMO)

An organization that provides comprehensive health care coverage to its members through a network of doctors, hospitals and other health care providers.HIPAA

A federal law which outlines certain rules and requirements employer-sponsored group healthplans, insurance companies and managed care organizations must follow to provide health care insurance coverage for individuals and groups; most recently amended to add privacy rules which became effective April 14, 2003.I

individual coverage

Health care coverage for a member, but not the member's spouse and/or dependents.in-network

Covered services provided or ordered by your primary care physician (PCP) or another network provider referred by your PCP.inpatient services

Services provided when a member/subscriber is registered and treated as a bed patient in a health care facility such as a hospital.insured person

The person to whom health care coverage has been extended by the contract holder, sometimes referred to as a member/subscriber.J

K

L

M

maximum allowance

A fixed amount that providers agree to accept as payment in full for a particular covered service.maximum annual benefit

The maximum dollar amount your healthplan will pay for a particular health care service or for all health care services provided to you during one year.Medicaid

A joint federal and state funded program that provides health care coverage for low-income children and families, and for certain aged and disabled individuals.medical group

A licensed group of doctors or health care providers that contract with a health plan to deliver health care services to plan members/subscribers.Medicare

The federal program established to provide health care coverage for eligible senior citizens and certain eligible disabled persons under age 65.Medicare Part A

The federal program established to provide health care coverage for eligible senior citizens and certain eligible disabled persons under age 65. Medicare Part A provides basic hospital insurance coverage automatically for most eligible persons.

Medicare Part B

The federal program established to provide health care coverage for eligible senior citizens and certain eligible disabled persons under age 65. Medicare Part B provides benefits to help cover the costs of doctors' services.Medicare Part C

The federal program established to provide health care coverage for eligible senior citizens and certain eligible disabled persons under age 65. Medicare Part C (also known as Medicare+Choice) expands the list of different types of entities allowed to offer health plans to Medicare beneficiaries.member

The person to whom health care coverage has been extended by the contract holder (generally their employer); sometimes referred to as the insured or insured person; generally used in the health maintenance organization (HMO) context.

N

network

The doctors, hospitals and other health care providers that a health plan has contracted with to deliver health care services to its members/subscribers.O

out-of-network

Services not provided, ordered or referred by your primary care physician (PCP).out-of-pocket maximum

The maximum amount you have to pay for eligible expenses under your health plan during a defined benefit period.outpatient services

Treatment that is provided to a patient who is able to return home after care without an overnight stay in a hospital or other inpatient facility.P

preauthorization

The process by which a member/subscriber or their primary care physician (PCP) notifies the healthplan, in advance, of plans for the member/subscriber to undergo a course of care such as a hospital admission or a complex diagnostic test.Preferred Provider Organization (PPO)

A healthplan that provides covered services at a discounted cost for subscribers who use network health care providers. PPOs also provide coverage for services rendered by health care providers who are not part of the PPO network; the subscriber generally pays a greater portion of the cost for such services.preferred drug list

A list of commonly prescribed drugs (also known as a prescription drug list). Not all drugs listed in a healthplan's prescription drug list are automatically covered under that plan.prescription drugs

Drugs and medications that, by law, must be dispensed by a written prescription from a licensed doctor.primary care physician (PCP)

The physician you choose to be your primary source for medical care. Your PCP coordinates all your medical care, including hospital admissions and referrals to specialists. Not all healthplans require a PCP.provider

A licensed health care facility, program, agency, doctor or health professional that delivers health care services.Q

R

S

T

U

V

W

X

Y

Z

Lewis Insurance

2525 S. Lamar Ste 11

Austin, TX

78704

No comments:

Post a Comment